Mortgage rates topped 6% last week for the first time since 2008. For the first time since the housing crash over a decade ago, mortgage rates have past 6%, rising right alongside the Federal Reserve’s so-called inflation-busting efforts.

The Hidden Cost Elephant in the Room

Housing prices don’t just depend on the mortgage rate. There’s the recession elephant in the room. Down payments are up by thousands. Factor in almost a 9% inflation rate and add that hidden cost, which is coming out of all your expenses, to the equation. Wait, we’re not done; add the price hikes across the board from groceries, clothing, tuition, etc. to utilities on top of that. Refer to a recent TLS article regarding taxes costing more than necessities, adding even more hidden cost.

Lakewood Is An Anomaly Market

Lakewood home prices have not gone down with the national numbers despite the so-called assessed values.

Property prices are supposedly falling, but our home prices still remain significantly high compared to just one year ago. That translates into the monthly mortgage payment increasing over the past year for both buyers and those looking to refinance.

The 30-year fixed-rate mortgage averaged 6.02% for the week ending on Sept. 15, according to the new Freddie Mac Primary Mortgage Market Survey (PMMS). That’s up from 5.89% the previous week and 2.86% the same week in 2021, and as stated above, represents the highest mortgage rate since the housing crash of 2008. Remember, that number does not account for the 8.9% decline in the GDP that you’ll have to factor into those pesky hidden costs.

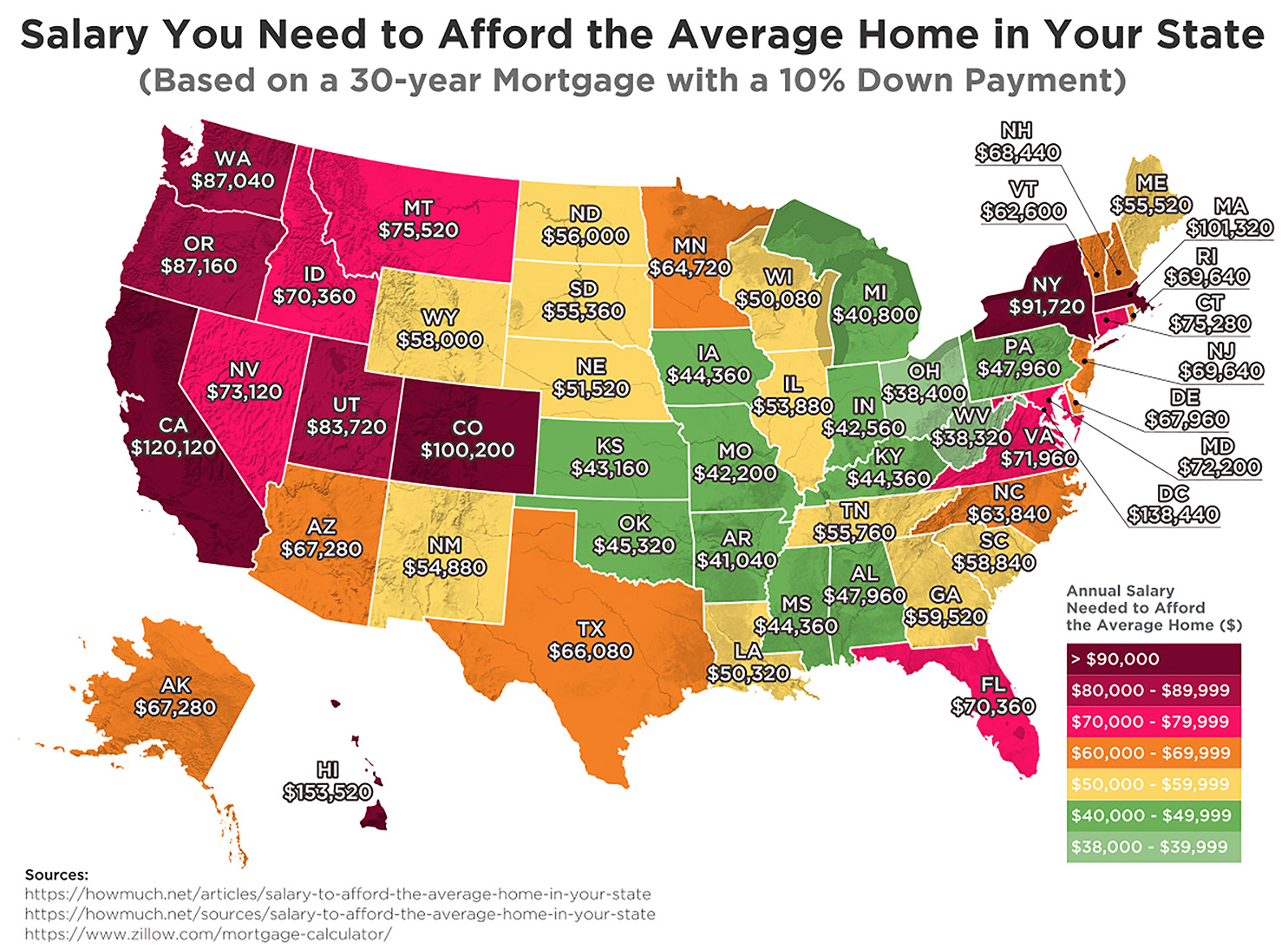

Today, the average monthly payment for a 30-year mortgage (principal, interest, and private mortgage insurance) is close to $2,430, according to Redfin’s mortgage calculator. This estimate is based on a median house price of $406,890 and a 10% down payment. That more or less fits the Lakewood profile although prices here are up to $100,000+ more than that and a larger down payment is more often than not necessary.

About a year ago, that same buyer would have been paying only $1,610 per month, based on a 2.86% mortgage rate and a median national house price of about $375,410. That’s in the neighborhood (pun intended) of $800 more every month.

Actually, new homebuyers are paying $820 more each month on their mortgages compared to the same time a year ago. Again, that’s not considering all the hidden costs-of-living and unemployment statistics. The Fed’s actions are intended to weigh on the economy, and officials expect that will also push unemployment even higher. Officials projected that joblessness will rise to 4.4% next year — considerably higher than the 3.7% now — and stay there through 2024. Economic growth, policymakers expect, will be slower, so the percentage of income eaten up by mortgages will be greater. Another hidden cost.

Freddie Mac informs us that higher interest rates will surely weaken real estate demand and accelerate a downward pressure on home prices. However, this is not applicable across the board here in Lakewood. Nationally, housing inventory levels have been climbing steadily. At the present rate of sales activity, it would take 10.9 months to exhaust the current supply of homes for sale in the market, according to data from the Census Bureau and Housing and Urban Development (HUD). The last time the metric was this high was in March 2009. These current supply numbers do not reflect new construction, nor the increased cost for materials, appliances and utilities, so once again, Lakewood clearly does not fit into the new construction model.

Back in July, the 30-year mortgage rate averaged 5.48%. Mortgage payments, calculated as a percentage of income, accounted for nearly 25%. But prices continue to increase at more than three times the rate that central bankers target, making everyday life hard to afford for millions of Americans. Surely by now, we all feel the pain of weaker inflation; and its likely to get even more painful.

Higher interest rates also make it more expensive to borrow money to buy a car or expand a business, slowing consumer spending and corporate expansions. Higher interest rates slow down inflation by reducing demand as supply remains the same except the added cost of fuel and materials make goods and moving them more expensive across the board. Another cost to factor in. As money continues to cost more and more to borrow, and the dollar is worth less, fewer people are taking out mortgages to buy houses or get business loans to expand their companies. The theory is that raising rates will create less economic activity so that the supply of goods and services available can catch up to demand. But companies are actually experiencing weaker profits, sales and are hiring fewer people. The burden is on the consumer to take up the slack.

Slowing the economy is a painful process that sends unemployment higher. The Fed itself acknowledges that its tools are blunt and that its fight to control inflation risks tipping the economy into an outright recession.

For the first time since January, single-family home prices tumbled more than 3% to $403,000 in August. Prices are trending downward, but higher mortgage rates make owning a home more expensive or harder to be approved for a mortgage in the first place. Bear in mind, these are national averages and not Lakewood statistics which do not necessarily reflect those numbers.

Still, many Americans are waiting for a sharp downturn to achieve the dream of homeownership. In August, a Consumer Affairs survey found that 78% think a housing crash is on the horizon. Nearly two-thirds (63%) want it to occur, and 84 percent of respondents born roughly between 1997 and 2012 desire a significant downturn so they can afford a home.

Demand Is Way Down

As the Federal Reserve rate increases, the rising cost of living weighs down the U.S. real estate market, which has already slipped into a bonafide recession, and the National Association of Home Builders (NAHB) agrees.

“Tighter monetary policy from the Federal Reserve and persistently elevated construction costs have brought on a housing recession,” NAHB chief economist Robert Dietz said in an August press release.

The NAHB Housing Market Index, a measure of homebuilder concerns, weakened to 46 in September for the ninth straight month, down from 49 in August. This was also below the general market consensus of 47. In July, pending home sales plummeted 19.9% year-over-year, dropping 1% month-over-month. New home sales also declined 12.6% to 511,000 units in July. Mortgage applications slipped 1.2% for the week ending Sept. 9, according to the Mortgage Bankers Association (MBA), which was the fifth straight weekly decline and the month isn’t over.

Higher mortgage rates have lowered refinancing a home down more than 80% from last year. This could be the beginning of a much larger slowdown, and conditions look like they could get worse in 2023. Goldman Sachs economist Jan Hatzius wrote in a recent memo to clients, that home price growth could stall completely and average at zero percent in 2023.

“We expect home price growth to stall completely, averaging [zero percent] in 2023, while outright declines in national home prices are possible and appear quite likely for some regions, large declines seem unlikely.”

For the rest of 2022, the investment bank projects a 22% drop in new home sales, a 17% decline in existing home sales, and an 8.9% slide in the overall housing GDP.

Sam Hall, a property economist at Capital Economics, sees an even more bleak future for the housing industry:

“Stretched affordability continued to weigh on housing market activity in July and August, leaving mortgage applications for home purchase down by 40% from their high in January. A renewed rise in mortgage rates to above their previous peak of 6% in the first week of September will cause more pain for the housing market.”

Mortgage Rates Set to Rise Further

The Fed is widely anticipated to raise the benchmark federal funds rate by 75 basis points during this week’s two-day Federal Open Market Committee (FOMC) policy meeting. (Wednesday).

With inflation running higher than expected in August and multiple central bank officials warning of higher interest rates for a longer time, the 30-year mortgage rate could keep climbing throughout the rest of the year, according to industry experts.

The recent Bankrate Mortgage Rate Trend poll for Sept. 15–21 found that 78% say rates will go up. 11% think mortgage rates will stay the same, while another 11% believe they will go down. But policymakers predicted on Wednesday that they will raise borrowing costs to 4.4% by the end of the year — which would be another supersized rate increase, followed by another half-point adjustment upward. Officials estimated that rates will climb to 4.6% by the end of 2023, up from an estimate of 3.8% in June, when they last published estimates.

Greg McBride, the chief financial analyst at Bankrate, said in the survey, “Inflation remains broad-based and problematic; the Fed will continue to be aggressive in raising rates and there is more supply of mortgage-backed bonds that need to be absorbed as the Fed retreats.” In other words, it’s out of control.

Central bankers raised their policy interest rate by three-quarters of a percentage point, boosting it to a range of 3 to 3.25%. The federal funds rate was set at near zero as recently as March, and the Fed’s increases since then have made for its fastest policy adjustment since the 1980s. That’s over 40 years.

Again, these statistics don’t take into account all the hidden costs outlined above associated with the current recession which shows no signs of letting up any time soon.

There are many things to consider even if you think you are ready to buy.

A lot of statistics, but basically a useless article.

That’s what a real estate broker told me last week. This week, the bank told me the mortgage rate is now 7%. I added everything up and realized if I bought the house I would go broke. The good news is that the price of wood is now back to 2020 prices. More bad news is that the renovation company won’t pass on their savings.