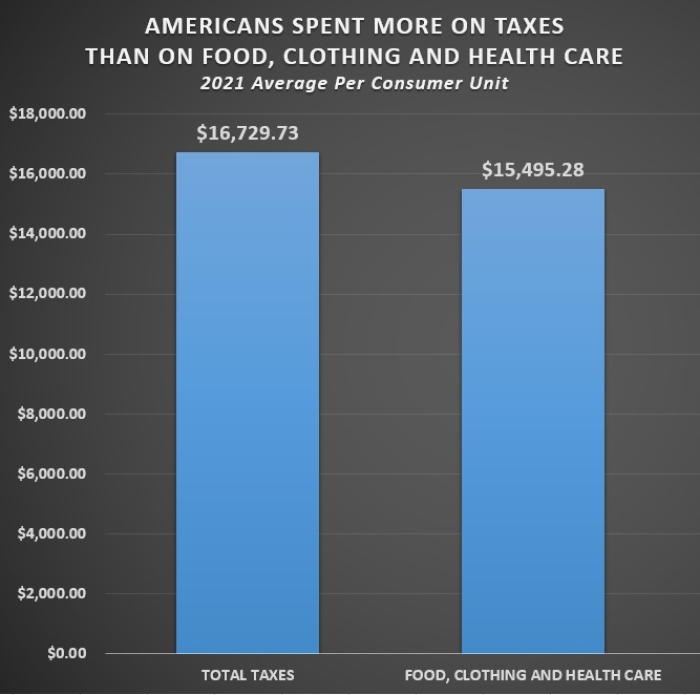

By Sarah Schweiber. According to newly released data from the Bureau of Labor Statistics, Americans in 2021 once again spent more on average in taxes than they did on food, clothing and health care combined. During 2021 American “consumer units” spent an average of $15,495.28 on food, clothing and health care combined, while paying an average of $16,729.73 in total taxes to federal, state and local governments.

The calculated taxes included $8,561.46 in federal income taxes; $5,565.45 in Social Security taxes; $2,564.14 in state and local income taxes; $2,475.18 in property taxes; $105.21 in other taxes—minus an average of $2,541.71 in stimulus payments received back from the government.

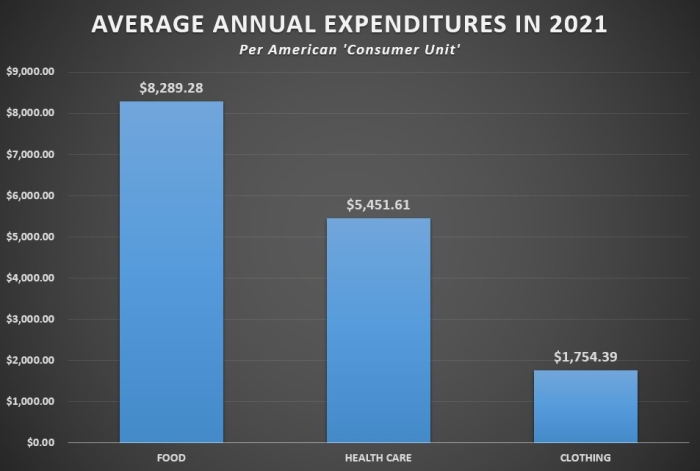

The expenses are broken down to $8,289.28 for food, $5,451.61 for healthcare and $1,754.39 for clothing.

“A consumer unit,” the BLS says in the glossary for its Consumer Expenditure Survey, “comprises either (1) all members of a particular household who are related by blood, marriage, adoption or other legal arrangements; (2) persons living alone or sharing a household with others or living as a roomer in a private home or lodging house or in a permanent living quarters in a hotel or motel, but who is financially independent; or (3) two or more person living together who use their income to make joint expenditure decisions.”

Enter The Guaranteed Income Program

Part of a pilot program which first began in the city of Los Angeles, one of the nation’s largest experiments with a guaranteed income. The idea is that the best way to close the wealth gap and give people the opportunity to build a more stable life is to provide unrestricted cash payments to some of the most vulnerable Americans.

The concept, sometimes referred to as Universal Basic Income, has had advocates for decades. Andrew Yang made it a centerpiece of his 2020 Democratic presidential campaign. At the same time, detractors have long argued that the approach incentivizes people not to work. Still, it is gaining traction, city by city.

More than 48 guaranteed income programs have been started in cities nationwide since 2020, according to Mayors for a Guaranteed Income, a network of leaders supporting such efforts at the local, state and federal levels. Some efforts are publicly funded, and others have nongovernmental support. Jack Dorsey, the former chief executive of Twitter, donated $18 million to help the initiative.

What About New Jersey? From The Official Site of The State Of New Jersey:

Policy or Initiative Description

The statement on nj.gov is only two sentences long, with no eligibility, application or even locale information! However, both Newark and Paterson have UBI programs serving their communities. It is up to the city and township Mayors to initiate a UBI program.

But governments can test out Universal Basic Income (UBI) with regional, state, or municipal pilots. UBI allows workers to be more selective by eliminating the need to accept poor working conditions to make ends meet, and can allow unemployed individuals to more time to gain skills needed to re-enter the workforce.

So far, only Newark and Paterson Mayors have signed on to the initiative.

The Newark Movement for Economic Equality is more complicated than most. This program provides $250 every two weeks and $3,000 every six months to 400 participants. The program launched in Fall 2021 by Mayor Ras J. Baraka and will last for two years.

The Paterson Guaranteed Income Pilot provides $400 per month for 12 months to 110 residents. The program began in 2021 by Mayor André Sayegh.

Considering the number of community help organizations for every demographic group and their income status, one would think there should be no obstacles to instituting a UBI program in Lakewood.

Note that eligibility for UBI is not necessarily limited by participation in any other program, such as the IRS’ Earned Income Tax Credit (EITC) as UBI is strictly a wholly local initiative with its own program requirements. (See Below).

As of now, many Lakewood residents may only be eligible for the IRS’ Earned Income Tax Credit (EITC). The EITC is one of the federal government’s largest refundable tax credits for low-to moderate-income families. The recent expansion of this credit means that more people may qualify to have at least some much-needed money put back in their pocket. Since food, clothing and tuition expenses are not tax deductible, that still might not help enough for eligible families, even with the 2021 expanded credits.

The IRS urges people to check to see if they qualify for this important credit. While people with income under a certain amount aren’t required to file a tax return because they won’t owe any tax, those who qualify for EITC may get a refund if they file a 2021 tax return.

Enter The Universal Basic Income:

California has become the epicenter of the UBI movement. The Los Angeles program, funded primarily by the city, benefits 3,200 people who have at least one child, as well as an annual income below the federal poverty level. Several cities have moved ahead with efforts using private money: Oakland pledged to give 600 low-income families $500 for 18 months, and in San Diego, some families with young children will get $500 a month for two years.

Last year, the state set aside $35 million over five years for cities to carry out pilot programs, which can use different criteria, including income level, people leaving the foster care system and residence in low-income neighborhoods. An application process for municipalities to tap into those funds is underway.

Beyond California, 300 Atlanta residents who live below the federal poverty level are receiving $500 a month for a year, and in Minneapolis, 200 residents from designated low-income neighborhoods will receive $500 a month for two years. This fall, 260 people living in motels or emergency shelters in Denver will receive a $6,500 payment and will get an additional $500 a month for 11 months, with payments planned for 560 more people.

Michael Tubbs, who as mayor of Stockton, Calif., put in place one of the country’s first guaranteed income programs in 2019. These payments are not meant to be a sole means of income but aim to provide a buffer for people to break the cycle of poverty. Mr. Tubbs frames the programs as crucial tools in achieving racial justice for Black people and Latinos. It is important to note that UBI programs are targeted at the Mayoral level and are subject to what some may call the whims or biases of the criteria. Mayor Tubbs provides the perfect example:

“The ways in which racism and capitalism have intersected to steal wealth from some communities,” he said, “creates the disparities we see today.”

Damon Jones, an economics professor at the University of Chicago, who has studied such programs, noted that unrestricted cash — including stimulus payments — was used broadly by the federal government to stem the economic devastation of Covid-19.

“Policymakers were surprisingly open to this idea following the onset of the pandemic,” Mr. Jones said. Now the emergency aid programs have largely lapsed, ending what for some was a lifeline.

Opponents argue that guaranteed income programs are too expensive and are counterproductive.

Oren Cass, executive director of American Compass, a conservative-leaning think tank, said the case against guaranteed income was not that people “receiving random windfalls can’t benefit from them — in at least some cases, they can and do. It’s that a permanent and society-wide system to provide for everyone would destroy fundamental elements of the social contract and create the wrong incentives for people as they make choices about their life’s course,” he said. “You can’t pilot that.”

Beyond philosophical objections, researchers say applying lessons from pilot programs like the one in Los Angeles on a nationwide scale will be difficult.

An analysis from the Jain Family Institute, a nonprofit that has studied several pilot programs, argues that the best pathway toward a national guaranteed income isn’t through scaling up a pilot, but in reforming and expanding existing federal programs, like the earned-income tax credit and the child tax credit.

“It does not make sense to take a municipal program and build it when there are already programs in place that can be reformed,” said Stephen Nunez, lead researcher on guaranteed income at the Jain Family Institute.

For example, Dr. Nunez said, California — along with nearly a dozen other states — already has a form of child tax credit. In California, parents with annual income of less than $30,000 qualify. “These can be expanded,” he added.

Based on the pilot in Stockton, a struggling inland port city of 320,000 in the Central Valley, Mr. Tubbs thinks local programs can play an important role in research and gaining public support for no-strings-attached cash assistance.

“When I first started working on this nearly five years ago, people called me crazy,” said Mr. Tubbs, 32, who lost a re-election bid in 2020 and is now an adviser to Gov. Gavin Newsom, a proponent of guaranteed income.

Mr. Tubbs’s passion for the idea is rooted in personal experience. He grew up in Stockton with a single mother, and they lived on a tight budget. Guaranteed income programs like those sprouting now, he said, could have helped his family.

UBI As Employment Expansion:

Preliminary research from a pair of college professors, based on the first year of Stockton’s two-year program, found that giving families $500 each month reduced those households’ income fluctuations, enabling recipients to find full-time employment. Researchers found that 28 percent of recipients had full-time employment when the program started in February 2019; a year later, the figure was 40 percent.

In one case, a participant had been studying to get his real estate license for more than a year — a pathway to more consistent, higher-paying work — but could not find time to study while piecing together an income doing gig jobs. The money from the pilot program, researchers found, gave him the time to study and get his license.

Now the lessons are being tested on a much broader scale.

Abigail Marquez, a general manager overseeing the Los Angeles pilot program, said the goal of her city’s effort was to promote changes to the ways federal public benefit programs were designed.

“Many, if not all, public benefit program regulations contradict each other, are difficult to navigate and are not focused on creating pathways to greater economic opportunity,” Ms. Marquez said. (Some states, including California, have built-in exemptions to ensure that accepting funding from the pilot programs does not put recipients at risk of losing certain state and federal assistance.)

The Los Angeles program received $38 million from the city. A small portion of the money comes from private funds. According to city data, one-third of adults in Los Angeles are unable to support their families on income from full-time work alone.

“When you provide resources to families that are struggling, it can give them the breathing room to realize goals that many of us are fortunate enough to take for granted,” Mayor Eric Garcetti said when the program began.

Universal basic income payments in each state in 2022:

Birmingham, Alabama

- Program: Embrace Mothers

- Length: One year

- Payments: $375 a month for one year

- Participants: 110 single mothers

Alaska

- Program: Alaska Permanent Fund

- Length: Annual

- Payments: $1,114 in 2021

- Participants: Alaska residents

Compton, California

- Program: Compton Pledge

- Length: December 2020 to December 2022

- Payments: $1,800 every three months for two years

- Participants: 800

Long Beach, California

- Length: Fall 2021 to Fall 2022

- Payments: $500 a month for one year

- Participants: 500

Los Angeles, California

- Length: Three years

- Payments: $1,204 a month

- Participants: 150 people ages 18 to 24 who are receiving general relief benefits

Los Angeles, California

- Program: Big Leap

- Length: January 2022 to January 2023

- Payments: $1,000 a month for one year

- Participants: Approximately 3,000

Marin County, California

- Length: 2021 to 2023

- Payments: $1,000 a month for two years

- Participants: 125 low-income women raising at least one child under 18 years old

Mountain View, California

- Program: Elevate MV

- Length: One year

- Payments: $500 every month

- Participants: 166

Oakland, California

- Program: Oakland Resilient Families

- Length: Summer 2020 to present

- Payments: $500 a month for 18 months

- Participants: 600

Sacramento, California

- Program: Direct Investment Program in Sacramento

- Length: June 2021 to June 2022

- Payments: $300 a month for two years

- Participants: 100

South San Francisco, California

- Program: The South San Francisco Guaranteed Income Program

- Length: October 2021 to October 2022

- Payments: $500 a month for one year

- Participants: 135

Santa Clara County, California

- Program: County of Santa Clara’s Basic Income Pilot

- Length: June 2020 to early 2022

- Payments: Up to $1,000 a month

- Participants: 2,400 to 2,500 young adults transitioning out of foster care

Stockton, California

- Program: SEED (Stockton Economic Empowerment Demonstration)

- Length: February 2019 to February 2021

- Payments: $500 a month for two years

- Participants: 125

West Hollywood, California

- Program: West Hollywood Pilot for Guaranteed Income

- Length: April 2022 to October 2023

- Payments: $1,000

- Participants: 25 randomly selected West Hollywood residents, age 50 or above, who identify as LGBTQIA

Atlanta, Georgia

- Program: I.M.P.A.C.T. (Income Mobility Program for Atlanta Community Transformation)

- Length: One year

- Payments: $500 a month for one year

- Participants: 300 Atlanta residents who live below 200% of the federal poverty line

Georgia

- Program: In Her Hands

- Length: Beginning early 2022 for at least two years

- Payments: $850 a month for two years; some may receive a lump sum payment

- Participants: 650 Black women, initially in Atlanta’s Old Fourth Ward

Gainesville, Florida

- Program: Just Income GNV

- Length: Winter 2021/2022 to early 2023

- Payments: $1,000, then $600 a month for 11 months

- Participants: 115 formerly incarcerated people

Chicago, Illinois

- Length: One year from TBD 2022 start date

- Payments: $500 a month

- Participants: 5,000 low-income people making less than $35,000 a year

Gary, Indiana

- Program: Guaranteed Income Validation Effort

- Length: Spring 2021 to Winter 2022

- Payments: $500 a month for one year

- Participants: 200

Louisville, Kentucky

- Program: YALift! (Young Adult Louisville Income for Transformation)

- Length: One year

- Payments: $500 a month

- Participants: 150 young people between the ages of 18 to 24

New Orleans, Louisiana

- Program: Financial literacy program

- Length: 10 months

- Payments: $350 a month

- Participants: 125 young people between the ages of 16 to 24 either unemployed or not in school

Shreveport, Louisiana

- Length: March 2022 to March 2023

- Payments: $660 a month for one year

- Participants: 110 single parents or legal guardians of school-aged children

Cambridge, Massachusetts

- Program: Cambridge Recurring Income for Success and Empowerment

- Length: June 2021 to December 2022

- Payments: $500 a month for 18 months

- Participants: 120

Chelsea, Massachusetts

- Program: Direct Assistance Stipend Program

- Length: November 2020 to present

- Payments: Between $200 to $400 a month

- Participants: 2,000

Lynn, Massachusetts

- Program: Family Health Project

- Length: May 2021 to May 2024

- Payments: $400 a month to new moms for a child’s first three years

- Participants: 15

Minneapolis, Minnesota

- Program: Minneapolis Guaranteed Basic Income Pilot

- Length: Spring 2022 to spring 2024

- Payments: $500 a month for two years

- Participants: 200 families

St. Paul, Minnesota

- Program: People’s Prosperity Guaranteed Income Pilot

- Length: October 2020 to May 2022

- Payments: $500 a month for 18 months

- Participants: 150

Jackson, Mississippi

- Program: Magnolia Mother’s Trust

- Length: December 2018 to present

- Payments: $1,000 a month for one year

- Participants: 100 low-income, Black mothers

Newark, New Jersey

- Program: Newark Movement for Economic Equity

- Length: Fall 2021 to Fall 2022

- Payments: Bi-weekly payments of $250 and semi-annual payments of $3,000 over two years

- Participants: 400

Paterson, New Jersey

- Program: Guaranteed Income

- Length: July 2021 to July 2022

- Payments: $400 a month for one year

- Participants: 110

Santa Fe, New Mexico

- Program: The City of Santa Fe Learn, Earn, Achieve Program

- Length: 2021 to 2022

- Payments: $400 a month for one year

- Participants: 100 young parents enrolled at Santa Fe Community College

New York

- Program: Creatives Rebuild New York

- Length: 18 months

- Payments: $1,000 a month

- Participants: 2,400 artists

Hudson, New York

- Program: HudsonUp

- Length: 2020 to 2025

- Payments: $500 a month for five years

- Participants: 25

New York, New York

- Program: The Bridge Project

- Length: Three years from acceptance

- Payments: $1,000 a month for three years (Phase One)

- Participants: 100 pregnant or new mothers with a baby under one year (Phase One)

Rochester, New York

- Program: Guaranteed Basic Income

- Length: Two years

- Payments: $500 a month for one year

- Participants: 175 low-income families

Ulster County, New York

- Program: Project Resilience

- Length: Spring 2021 to Spring 2022

- Payments: $500 a month for one year

- Participants: 100

North Carolina / Cherokee Tribe

- Program: Eastern Band of Cherokee Indians Casino Dividend

- Length: Annual

- Payments: $4,000 to $6,000 a year

- Participants: Every tribal member

Durham, North Carolina

- Program: Excel Pilot Program

- Length: 2022 to 2023

- Payments: $500 a month for one year

- Participants: 115 Durham residents who were incarcerated in the last five years

Philadelphia, Pennsylvania

- Program: No confirmed name yet

- Length: March 2022 for at least one year

- Payments: $500 a month for at least 12 months

- Participants: 60 people who have received TANF for at least five years

Pittsburgh, Pennsylvania

- Program: Assured Cash Experiment PGH

- Length: Late 2020 to late 2022

- Payments: $500 for two years

- Participants: 100 African-American women and 100 people of any race or gender, all from low-income zip codes

Providence, Rhode Island

- Program: Providence Guaranteed Income Pilot

- Length: November 2021 to December 2022

- Payments: $500 a month for one year

- Participants: 110

Columbia, South Carolina

- Program: Columbia Life Improvement Monetary Boost

- Length: Early 2021 to present

- Payments: $500 a month for one year

- Participants: 100 low-income fathers

Alexandria, Virginia

- Program: Alexandria Guaranteed Income Pilot

- Length: December 2021 to December 2023

- Payments: $500 a month for two years

- Participants: 150

Richmond, Virginia

- Program: Richmond Resilience Initiative

- Length: October 2020 to December 2022

- Payments: $500 a month for one year

- Participants: 18 low-income, working families who do not qualify for aid

Tacoma, Washington

- Program: Growing Resilience in Tacoma

- Length: December 2021 to December 2022

- Payments: $500 a month for one year

- Participants: 110

Washington, DC

- Program: Strong Families, Strong Future DC

- Length: One year from February 2022

- Payments: $900 per month for one year

- Participants: 132 new and expectant mothers in Wards 5, 7 and 8

Overview Of the IRS’ EITC Program:

- Expanded EITC for people who do not have qualifying children

More workers without qualifying children can qualify for the EITC, and the maximum credit amount is nearly tripled for these taxpayers this year. For the first time, the credit is now available to both younger workers and senior citizens. There is no upper age limit for claiming the credit if taxpayers have earned income.

The EITC is generally available to workers without qualifying children who are at least 19 years old with earned income below $21,430 for those filing single and $27,380 for spouses filing a joint return. The maximum credit for taxpayers with no qualifying children is $1,502. There are also special exceptions for people who are 18 years old and were formerly in foster care or are experiencing homelessness. Full-time students under age 24 don’t qualify.

- Some taxpayers can use 2019 earned income to figure their EITC

- Taxpayers can elect to use their 2019 earned income to figure their 2021 earned income credit if their 2019 earned income is more than their 2021 earned income. This option may help workers get a larger credit if they earned less in 2021 from employment. Taxpayers can review line 27c of the instructions for Form 1040 for more information.

- Phaseouts and credit limits

- For 2021, the amount of the credit has been increased and the phaseout income limits have been expanded.

- Any third-round Economic Impact Payments or child tax credit payments received are not taxable or counted as income for purposes of claiming the EITC. People who are missing a stimulus payment or got less than the full amount may be eligible to claim the recovery rebate credit on their 2021 tax return.

New Law Changes Expanded the EITC For 2021 And Future Years. These Changes Include:

- More workers and working families who also have investment income can get the credit.

- Starting in tax year 2021, the amount of investment income they can receive and still be eligible for the EITC increases to $10,000.

- After 2021, the $10,000 limit is indexed for inflation.

- Married But Separated Spouses Can Choose to Be Treated as Not Married for The Purposes Claiming EITC:

- To qualify, the spouse claiming the credit cannot file jointly with the other spouse. They must have a qualifying child living with them for more than half the year and either:

- Do not have the same principal residence as the other spouse for at least the last six months out of the year.

- Are legally separated according to their state law under a written separation agreement or a decree of separate maintenance and not live in the same household as their spouse at the end of the tax year for which the EITC is being claimed. Taxpayers should file Schedule EIC – Form 1040 and check the box showing them as married filing separately with a qualifying child.

- Single people and couples with children who have Social Security numbers can claim the credit, even if their children do not have SSNs:

- In this instance, they will get the smaller credit available to workers who do not have qualifying children. Taxpayers should complete Schedule EIC and attach it to Form 1040 or 1040-SR if they have at least one qualifying child, even if the child doesn’t have a valid SSN. For more information, taxpayers should review the instructions for Form 1040, line 27a, and Schedule EIC.

You failed to mention that the Alaska fund and the tribal funds are both profit sharing funds. In the case of AK it is oil profits and in the case of Native American tribes these funds are profit sharing on gambling profits. The remainder of these wealth redistribution schemes are all funded by taxes paid by others.

What happens when a family is receiving means tested benefits like SNAP, will the increased income impact their ability to qualify for these benefits?

Wow! My SNAP is income! 87,000 IRS agents? I’m gonna move to AK (wherever that is, the only AK I see in this article is in L AK ewood) or maybe Alaska, wonder if my wife is maskim? I mean with the blech and candles in an igloo. I’ll ask her. Would an igloo Sukka be kosher? Do I have to be a Native American for the profit sharing gig? I’d like to get in on the oil profits with the gas prices the way they are. Have you really tested these benefits. Is there a cheder, yeshiva, mikva and Kosher Chinese? Please write an article.

Just what we need…more SOCIALIST HANDOUTS!!!!

This is so packed with fact. How is it an opinion?

This is awesome! My kids will not have to work hard, go to college or spend ridiculous hours advancing careers and such. They can mow lawns once a week or do simple jobs… and have all their expenses covered by the poor saps who stupidly work hard! I won’t even have to pay for their education! Who needs it! Grab any old simple and minimal job and let everyone cover your expenses! Wow. Think of how amazingly society will progress after that. More and better goods will certainly be produced by all those stupid few people who feel they should produce things for free so they can make all the extra money to pay into this wonderful program!