Jackson Township officials have introduced the municipality’s $54.6 million budget for 2022, which features increased investments in police and public safety, expansive road improvement efforts and various community enhancements, while reducing the municipal tax rate from .501 to .500. New investments in the budget will be offset with funds from the township’s $9.1 million surplus, enabling the township to make investments while reducing the tax rate.

Jackson Township officials have introduced the municipality’s $54.6 million budget for 2022, which features increased investments in police and public safety, expansive road improvement efforts and various community enhancements, while reducing the municipal tax rate from .501 to .500. New investments in the budget will be offset with funds from the township’s $9.1 million surplus, enabling the township to make investments while reducing the tax rate.

“Balancing the need to invest in public safety, essential infrastructure and various community needs – like improvements to parks, playgrounds and fields – with responsible ways to fund such initiatives is always challenging,” said Jackson Township Mayor Michael Reina. “Over the past few years, the township has been fiscally prudent with its budget and, as a result, produced a substantial surplus. It’s this surplus that puts us in a strong position to make important investments, while keeping taxes flat.”

The 2022 budget was introduced formally by Terence Wall, township business administrator, on behalf of Mayor Reina, during a regularly scheduled meeting of the township council on March 22.

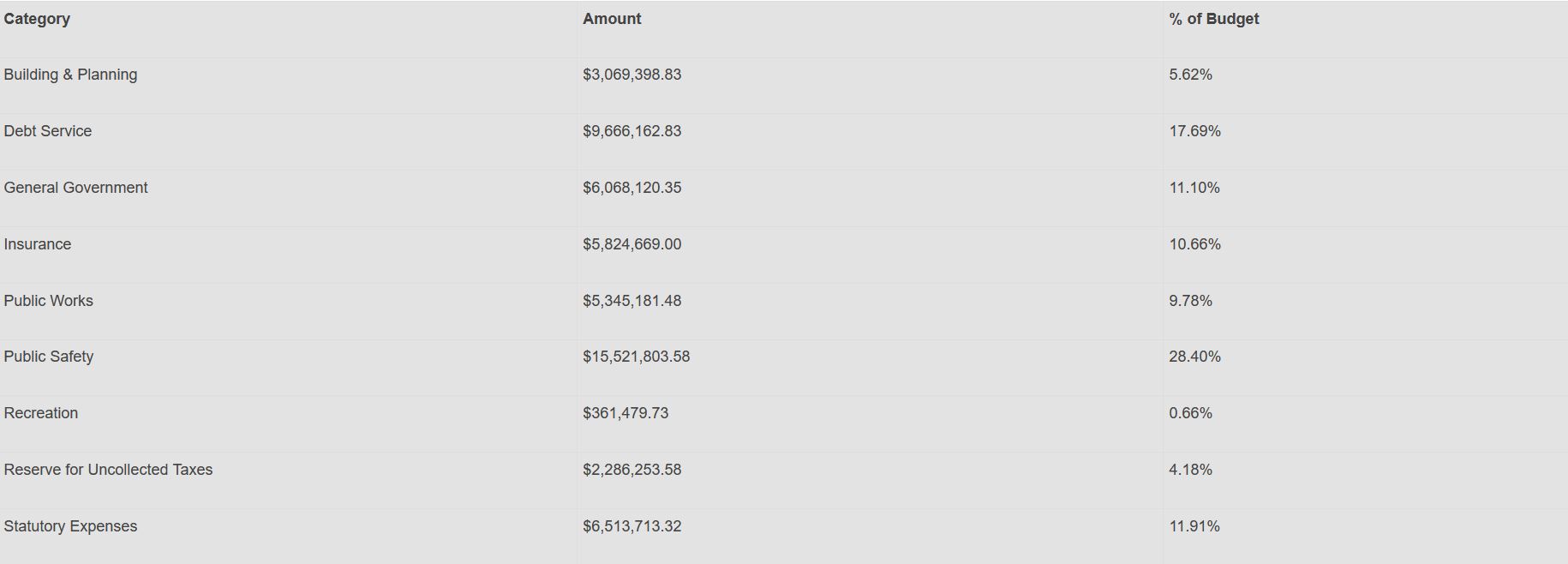

The budget for 2022 is set at $54,656,782.70 with the following expense allocations by category:

Budget highlights include the following:

- Surplus details: The township’s anticipated surplus for 2022 is $9,167,000. Over the past several years, the surplus fund has increased steadily through a combination of excess revenue generation and lower spending. For example, in 2021, township miscellaneous revenue exceeded the original budget by $2,552,615.12, largely due to increase in building department, or UCC fees; other fees and permits; and interest on investments and deposits. The surplus was further enhanced by additional, unanticipated revenue of $1,227,210.61 from fees associated from the assignment of off-duty police officers; the Ocean County Cares Grant; rental registration; tax collection and rental of cell tower space. Further, the township spent less than called for in its 2020 budget, generating another $2,713,521.35 for 2020 that lapsed into surplus savings.

- Increases for Public Safety: Investments in public safety will be made in police staff, professional accreditation services, vehicles, video and additional equipment.

- Road Improvement Effort: In 2021, the township completed a Roadway Rating Report, a comprehensive assessment of all township-owned roadways for the purpose of assessing overall roadway conditions. Now that the report is complete, the township is using it to initiate road improvement efforts throughout 2022, including efforts to improve and repair pavement, storm water drainage infrastructure, corner curb ramp accessibility and much more. Additional investments in road improvements will be on-going and announced publicly in the months ahead

- Community Enhancements: Last year, the township completed an assessment of all turf field facilities owned by the municipality. In 2022, new turf is being installed at township-owned turf fields, along with various site component upgrades. Additional improvements to parks and playgrounds will be on-going.

Municipal taxes represent just one portion of property tax bills paid by property owners in Jackson. Based on township estimates, the vast majority of property taxes, or approximately 56.35%, are used to fund the local school district. Approximately 19.80% of property taxes fund the municipal government; 18.49% goes to the county government; 4.17% funds fire districts; and 1.19% of property tax bills is set aside for open space.

A vote to adopt the budget will take place at the township council’s meeting on April 26th.