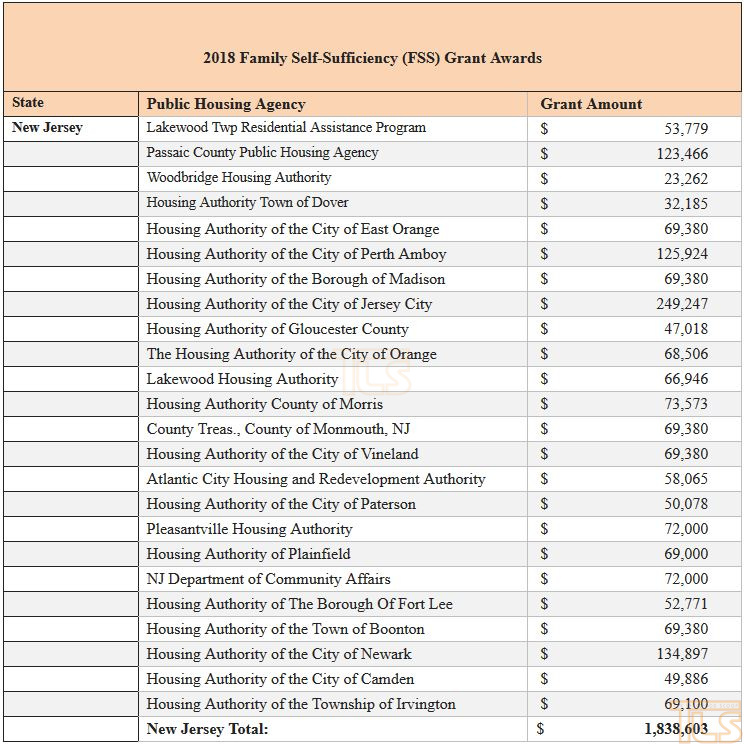

U.S. Housing and Urban Development (HUD) Secretary Ben Carson today awarded $1.8 million to dozens of public housing authorities in New Jersey to continue helping public housing residents participating in the Housing Choice Voucher Program and/or reside in public housing to increase their earned income and reduce their dependency on public assistance and rental subsidies. This grant is part of a national award totaling $74 million. Read more about the local impact of the grants announced today.

U.S. Housing and Urban Development (HUD) Secretary Ben Carson today awarded $1.8 million to dozens of public housing authorities in New Jersey to continue helping public housing residents participating in the Housing Choice Voucher Program and/or reside in public housing to increase their earned income and reduce their dependency on public assistance and rental subsidies. This grant is part of a national award totaling $74 million. Read more about the local impact of the grants announced today.

These grants renew HUD’s support of 689 public housing authorities through the Department’s Family Self-Sufficiency Program (FSS). HUD’s FSS Program helps local Public Housing Authorities to hire Service Coordinators who work directly with residents to connect them with programs and services that already exist in the local community. The program encourages innovative strategies that link housing assistance with a broad spectrum of services that will enable participating families to find jobs, increase earned income, reduce or eliminate the need for rental and/or welfare assistance, and make progress toward achieving economic independence and housing self-sufficiency.

“One of the most important things we can do as public servants is to help HUD-assisted families achieve their dreams,” said Secretary Carson. “Working with our local partners, HUD is connecting families to educational opportunities, job training, childcare and other resources that allow them to get higher paying jobs and, ultimately, become self-sufficient.”

“Few things feel better than taking control of your own life and crafting your future, and the Family Self-Sufficiency Program is an invaluable tool for public housing residents achieve to just that,” said Lynne Patton, HUD Regional Administrator for New York and New Jersey. “Families make the commitment; and HUD and housing authority staff are there every step of the way to assist with guidance to ensure residents remain on the pathway to financial independence.”

FSS participants sign a five-year contract that requires the head of the household to obtain employment and that no member of the household will receive certain types of public assistance at the end of the five-year term. These families have an interest-bearing escrow account established for them. The amount credited to the family’s escrow account is based on increases in the family’s earned income during the term of the FSS contract. If the family successfully completes its FSS contract, the family receives the escrow funds that it can use for any purpose, including debt reduction in order to improve credit scores, educational expenses, or a down payment on a home.

The average household income of FSS participants more than doubled during their time in the program, from $10,000 at the time of entry to more than $27,000 upon program completion.